Introduction

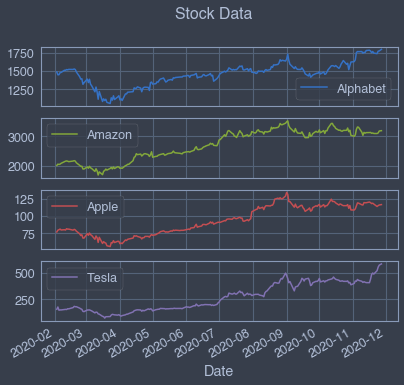

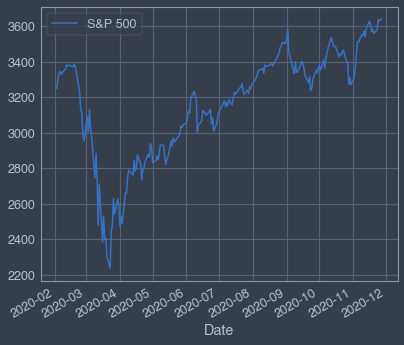

The Sharpe Ratio is a way of evaluating the value of an investment after subtracting for its risk. In this project we’ll use it to compare four stocks: Alphabet, Amazon, Apple, and Tesla. We’ll be using the S&P 500 to measure the overall volatility of the market.

Getting started

To start, we’ll load in the data which was pulled from Yahoo Finance. To account for the recent recession the data begins with the start of the current business cycle in early March.

#Import libraries

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

#Read in data

stock_data = pd.read_csv('https://raw.githubusercontent.com/lusignan/Sharpe-Ratio/main/stock_data.csv',

parse_dates=['Date'],

index_col='Date'

).dropna()

benchmark_data = pd.read_csv('https://raw.githubusercontent.com/lusignan/Sharpe-Ratio/main/stock_data.csv',

parse_dates=['Date'],

index_col='Date'

).dropna()

#Visualize stock data

stock_data.plot(title='Stock Data', subplots=True, linewidth = 1.5)

#Visualize S&P 500 data

benchmark_data.plot(linewidth = 1.5)

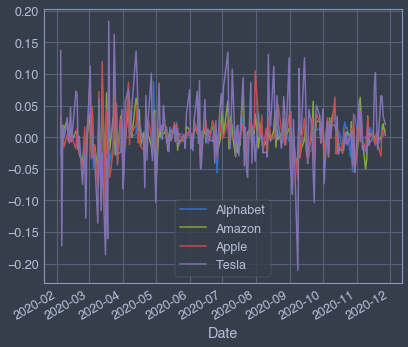

#Calculate daily stock returns

stock_returns = stock_data.pct_change()

#Plot daily returns

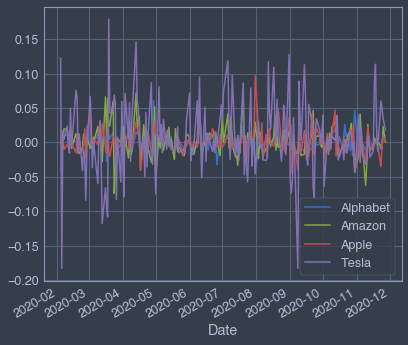

stock_returns.plot(linewidth = 1.5)

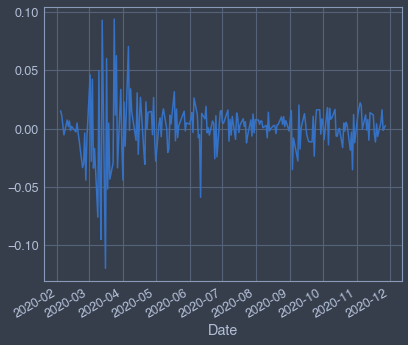

#Calculate daily S&P 500 returns

sp_returns = benchmark_data['S&P 500'].pct_change()

#Plot the daily returns

sp_returns.plot(linewidth = 1.5)

#Calculate the difference in daily returns

excess_returns = stock_returns.sub(sp_returns, axis=0)

#Plot the excess_returns

excess_returns.plot(linewidth = 1.5)

#Calculate the mean of excess_returns

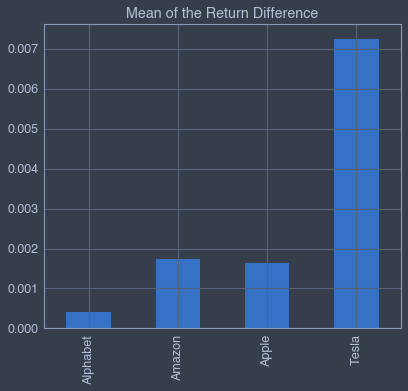

avg_excess_return = excess_returns.mean()

#Plot the average excess returns

avg_excess_return.plot.bar(title='Mean of the Return Difference');

#Calculate the standard deviations

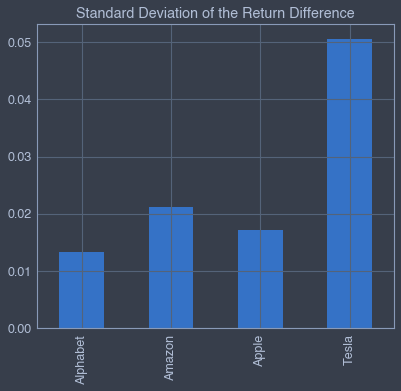

sd_excess_return = excess_returns.std()

#Plot the standard deviations

sd_excess_return.plot.bar(title='Standard Deviation of the Return Difference');

#Calculate the daily sharpe ratio

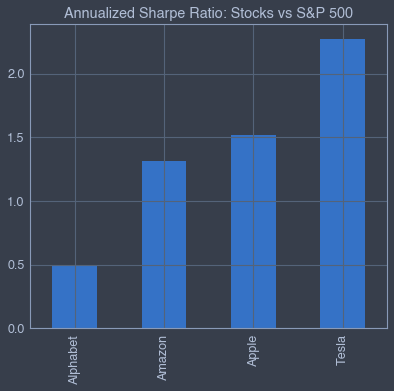

daily_sharpe_ratio = avg_excess_return.div(sd_excess_return)

#Annualize the sharpe ratio

annual_factor = np.sqrt(252)

annual_sharpe_ratio = daily_sharpe_ratio.mul(annual_factor)

#Plot the annualized sharpe ratio

annual_sharpe_ratio.plot.bar(title='Annualized Sharpe Ratio: Stocks vs S&P 500');

Conclusion

After accounting for market volatility, Tesla is the best of the four stock options to buy followed by Apple.

Twitter

Facebook

Reddit

LinkedIn